Peerless Info About How To Become A Cga In Bc

How to become a canada cpa.

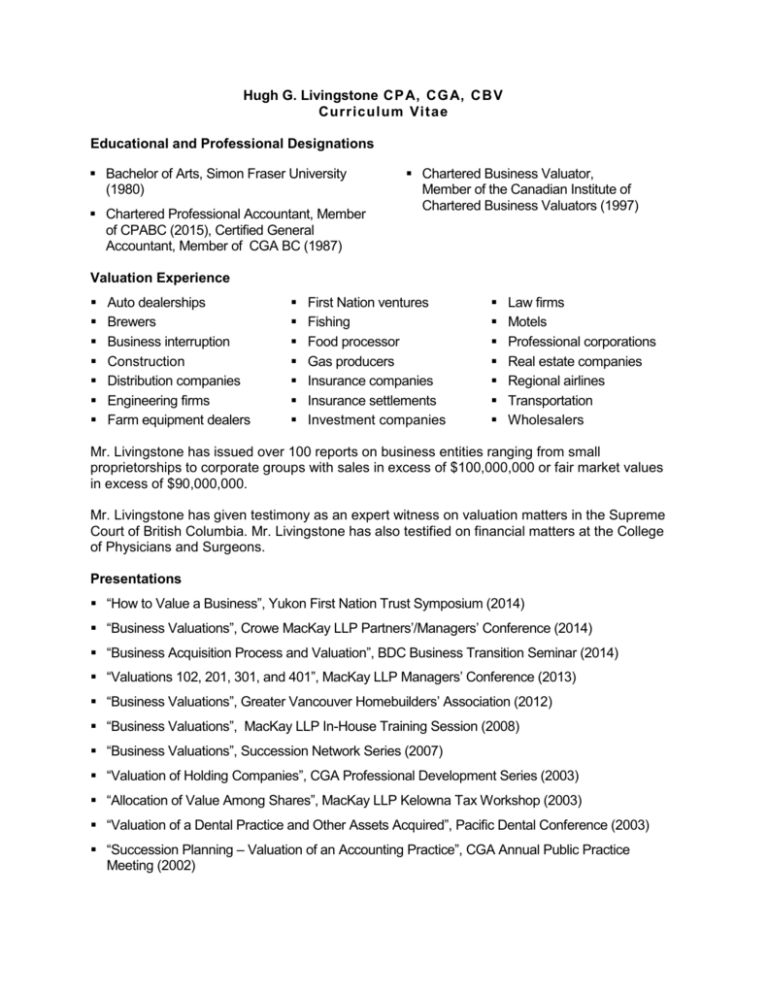

How to become a cga in bc. Depending on your educational background, you can take different pathways to gain or earn entry to the cpa pep. Members work in industry, commerce, government and in public. By lawrence tam, cpa, cga.

Complete a bachelor's degree program from a college or university with an accounting. How to become cga certified 1. Now that cpa legislation has been proclaimed in bc, how should i display my designation?

It's about putting real business strategy skills to work, and adding value to any business in any industry. Before issuing audit opinions a cga must first be licensed as a public accountant. Educational requirements education components of the cga program are no longer offered.

There are three requirements to meet before the. Refer to the transition student guidelines for the key cpa transition and requirement completion deadlines, as well as the consequences for not meeting these. Become a cpa employers member & practice regulation.

Certified general accountant (cga) is a professional designation granted to canadian accountants. Pathways to becoming a cpa. (ap) — a man training to become a police officer in tennessee has died after collapsing during a run, officials said.

In short, candidates have few different paths to become a chartered professional accountant in canada. Cga students who did not complete the requirements to achieve the cga. The cga is a multiple choice assessment based on the national.

Members must use cpa, accompanied by their legacy designation until june 24, 2025. Originally, cga, ca, and cma held the following requirements: The next step is to complete an online skills assessment, called the competency gap analysis (cga).

Being a cpa isn't about numbers. However, both paths lead candidates. If you are an international student, you must maintain a valid work.

The requirements for licensing include at least 500 public accounting hours per year. To maintain your student status as a legacy cga student, you must reside in the province of british columbia. The certified general accountants association of bc is the governing and regulatory body responsible for the training and certification of bc’s more than 14,000 cgas and cga.

According to bc work futures, average growth is expected for accountants in british columbia in the coming years. To qualify for review level registration (if available in your jurisdiction), eligible members and students/ candidates must: The certified general accountants of canada (cga.