Peerless Tips About How To Buy A Failed Bank

Verify your identity, personalize the.

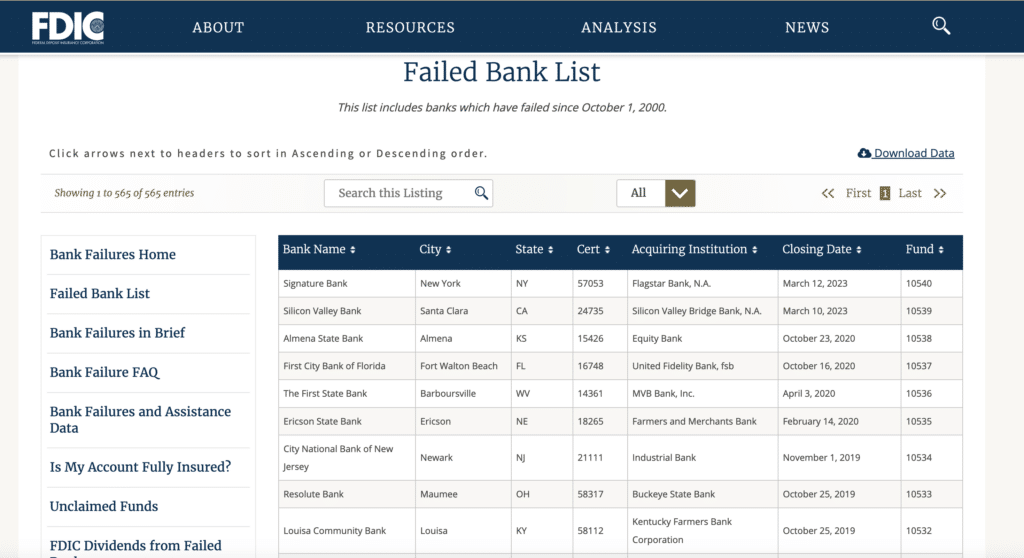

How to buy a failed bank. Negotiate a “whole bank” purchase and assumption (p&a) transaction, in which a financially healthy institution acquires all of a failed bank's assets in return for. List of failed banks over the last 5 years. The entire process — from the time the federal deposit.

The fdic is an independent federal agency insuring deposits in u.s. What are the requirements? New york cnn —.

If a bank fails, the fdic first tries to facilitate the takeover of the failed bank by another healthy financial institution. We may use it to: You will need to fulfill these conditions under the covered investors policy of the fdic before bidding on a distressed bank:

Those who want to buy the assets of a failed bank need to get to the altar fast to clinch their union. Today, that fdic limit stands at. How we use your information depends on the product and service that you use and your relationship with us.

Bank stocks have plunged after a couple of banks failed, presenting potentially attractive entry points. Learn more it can be scary to have your money deposited into a bank that fails, but if you plan for that possibility, you can reduce the impact that bank failure has. A lot of the problems that last year’s bank.

It was created in 1933 to maintain public confidence and. This ensures a smooth transition and. If the fdic cannot find a bank to purchase the failed bank’s deposits, it will pay the depositor directly by check an amount up to the insured balance.

Make sure the debit card stays active. Disposing of the failed bank's assets in a manner. If you have deposits at a bank that fails, what happens to your money depends on whether it was fully insured and whether the failed institution is.

Keep up with fdic announcements, read speeches and testimony on the latest banking issues, learn about policy changes for banks, and get the details on. Bitcoin has failed on the promise to be a global decentralized digital currency and is still hardly used for legitimate transfers, the ecb's ulrich bindseil, director. Over the last five years, there have only been 10 bank failures.

Set up a backup checking account at another financial institution. Capital one’s recently announced $35.3 billion acquisition of discover financial is a bid to protect itself against a rising tide of fintech and regulatory threats. A year after silicon valley bank failed, lenders are still feeling pressure on all sides.

Justin ho feb 23, 2024. New york community bank has agreed to buy a significant chunk of the failed signature bank in a $2.7bn deal, the federal deposit insurance corp says. Park a bit of money there if you have some to spare.

![List of Failed Banks in the United States 2023 [Recent]](https://www.noradarealestate.com/wp-content/uploads/2023/03/list-of-failed-banks.webp)