Perfect Info About How To Buy A Tax Deed

The true answer is no because to sell a tax deed, a buyer will expect to receive a.

How to buy a tax deed. The process of tax deed sales is going to vary depending on location. Most people find tax sale investing to be difficult. The most important things to due diligence when it comes to tax deed.

Taxes what is a tax deed? If you ask me, can i sell a tax deed? How does tax lien investing work?

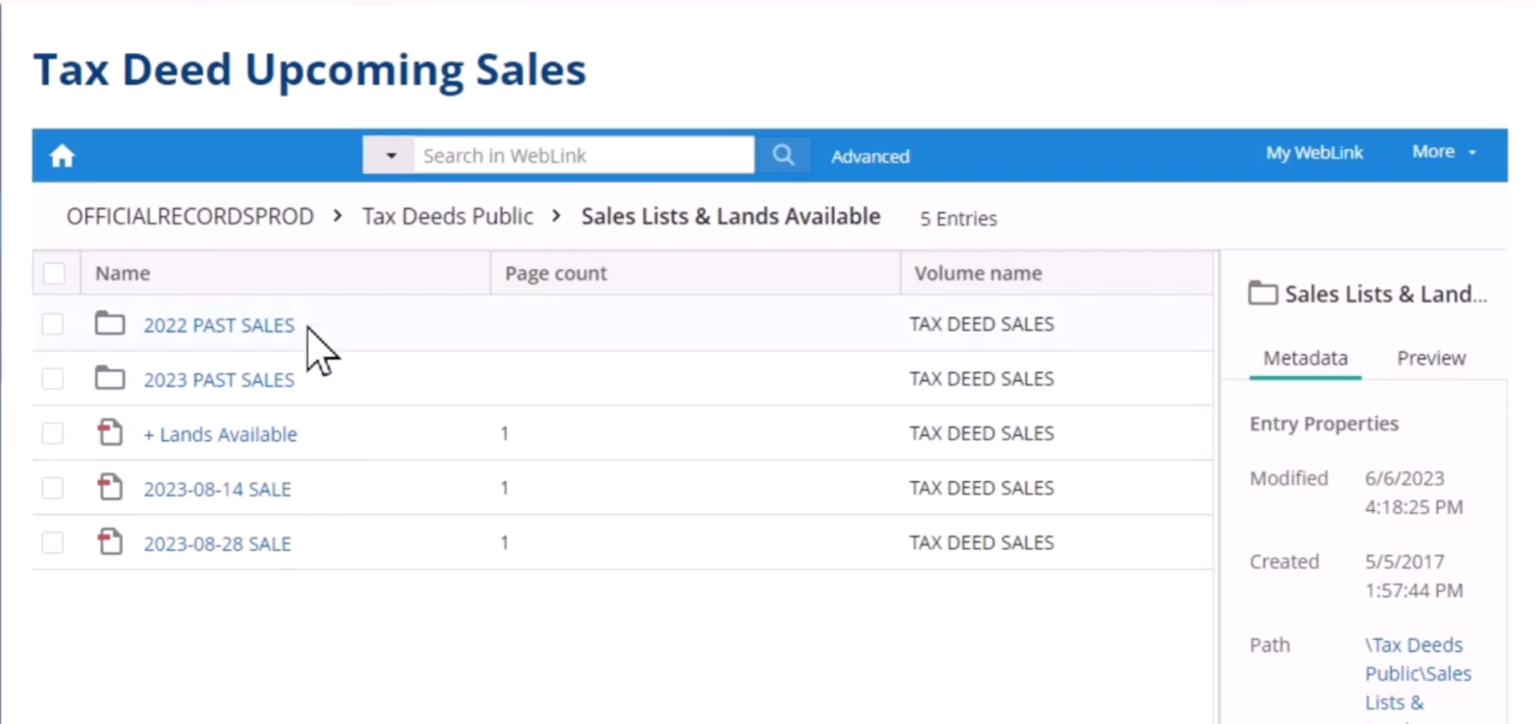

Rachel seidensticker looking for which sales have the best returns? When mortgaged homes go to auction, the. To find tax deed auctions, you can contact the county treasurer or go to the county’s website for auction dates and lists of available.

After completing this video you will understand just how simple it can be whe. The local government then places a lien on the. What is a tax deed?

But we do over 100 a year! The fraud is on the court. And don't forget to claim your free gi.

Locating tax deed auctions and property lists. Not just any lemon. The process of tax lien investing typically begins when a property owner fails to pay their taxes.

How to invest in a tax deed property. There is no guarantee that the property will be worth more than. Cost basis is the amount that you pay to buy an asset.

The first step you can take to invest in a tax deed. Investors can buy tax deeds at a tax deed sale, but they need to be aware of the risks involved. In some cases it can be adjusted upward if you also spend money increasing that asset’s value.

It s a legal document that changes ownership of a property to the government when the owner fails to pay property taxes. How tax deed auctions work, how they differ from other foreclosure auctions.