Outrageous Tips About How To Claim College Expenses

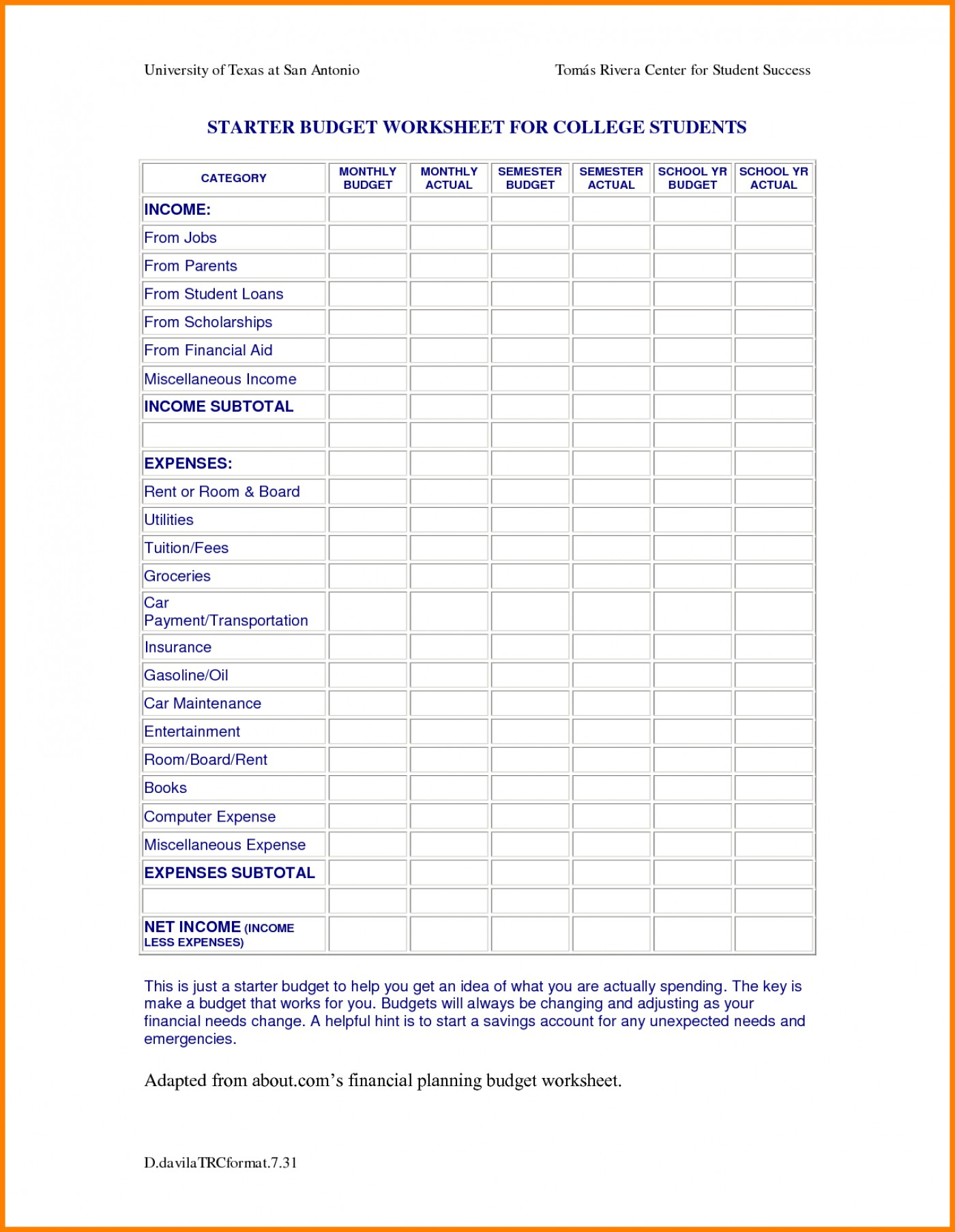

Oklahoma allows individuals to deduct up to $10,000 per year and joint filers to.

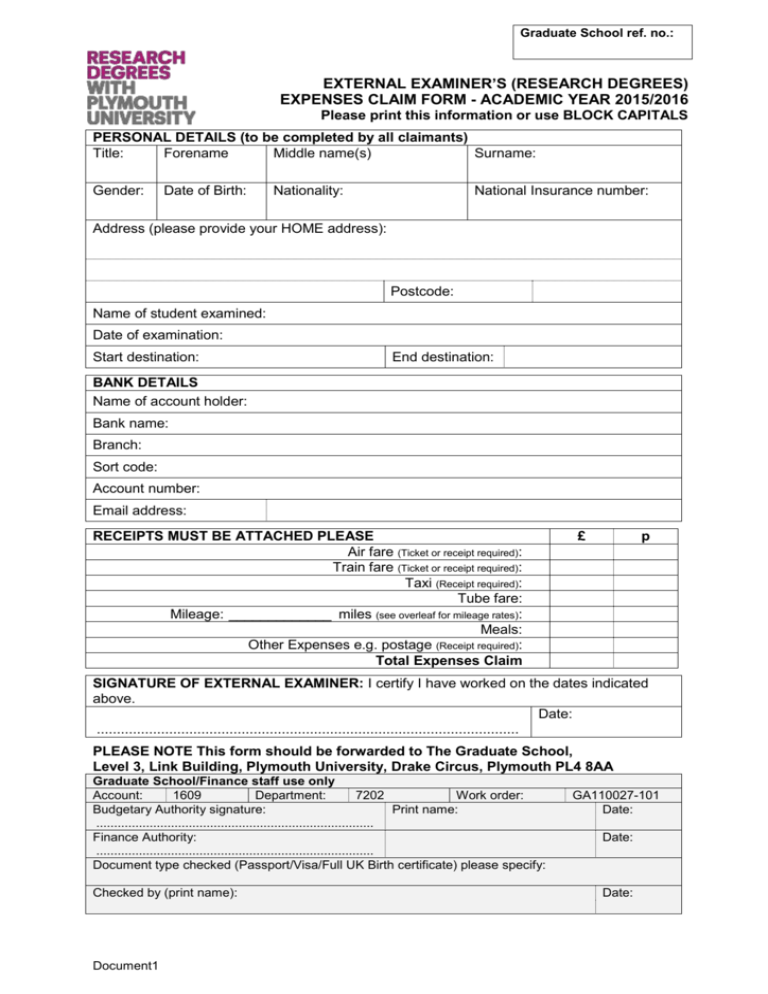

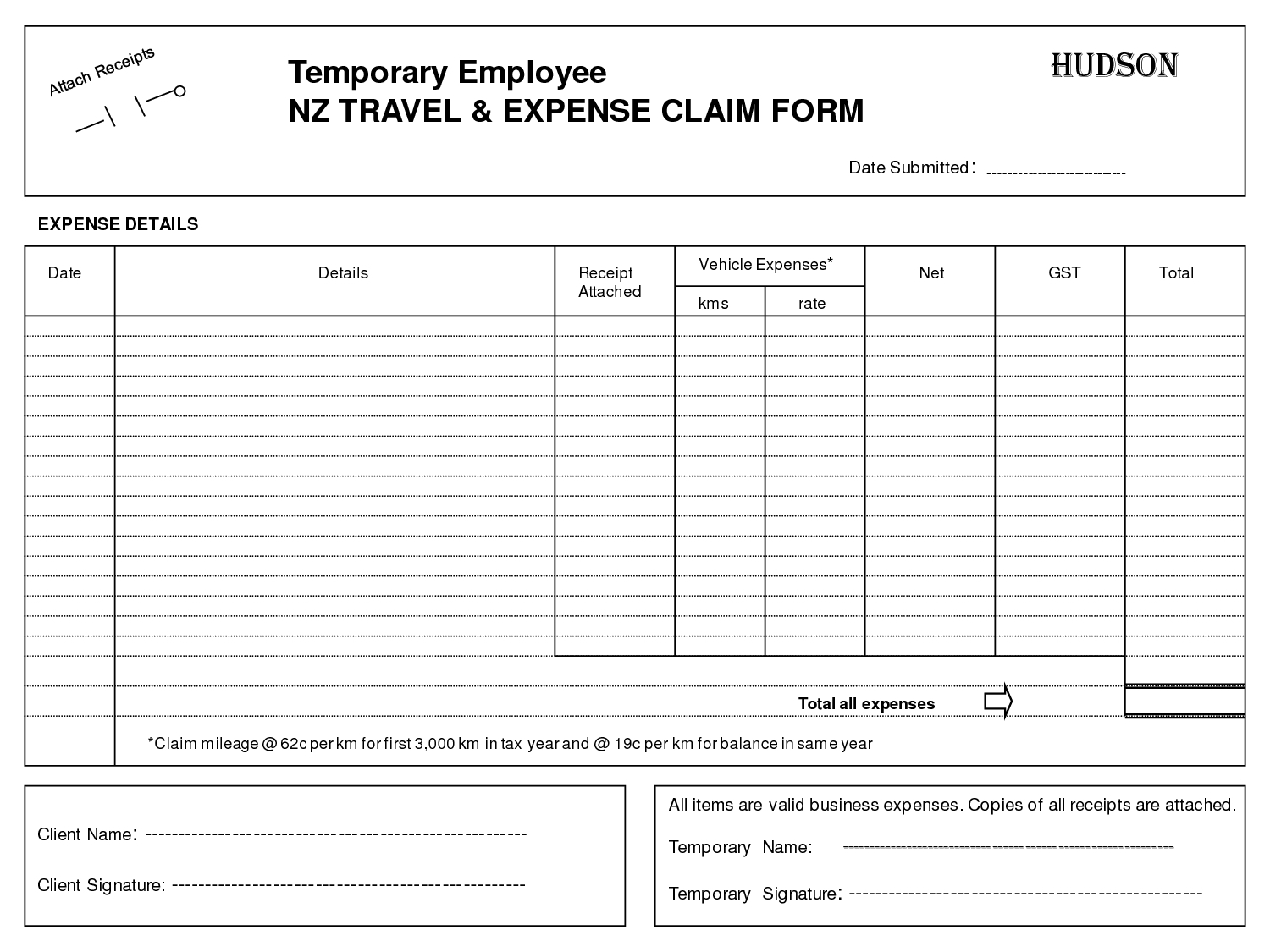

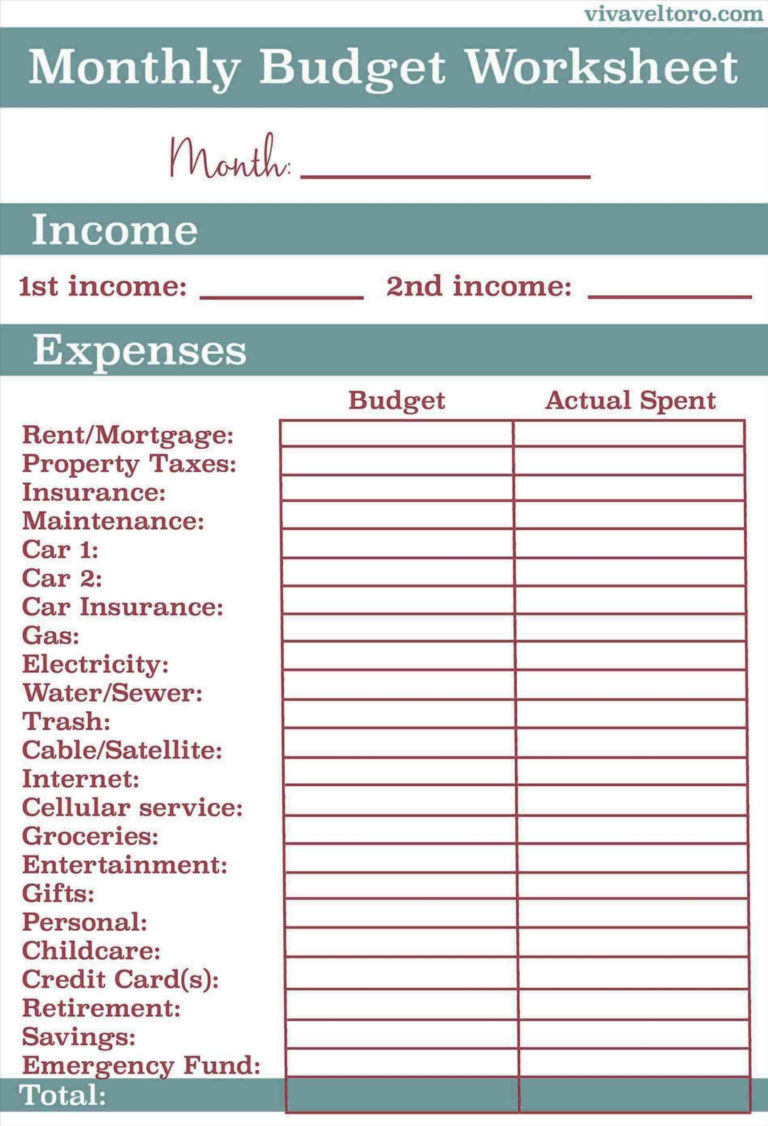

How to claim college expenses. The deduction for college tuition and fees became no longer available as of december 31, 2020. Number your receipts/documentation to match the expense line item in your claim. Medical expenses or student fees.

The principal of one of scotland's biggest colleges has charged more than £100,000 in expenses over the last 10 years, including more than £13,000 at a private. Qualifying expenses include what you pay in tuition and mandatory enrollment fees to attend any accredited public or private institution above the high. However, you can still help yourself with college expenses through.

Fees for maintaining or acquiring a license (broker, cpa, etc.) tutoring expenses. Dependent children can currently borrow $5,500 as a federal student loan for their first year of college. The american opportunity tax credit is a credit of up to $2,500 toward expenses for eligible students in the first four years of earning a degree.

Ohio residents can deduct up to $4,000 per beneficiary per year on their state taxes. Interest rates are currently 5.5% to 8.05%, and $5,500 is not. A married couple have three dependents, two in high school and one attending college full time.

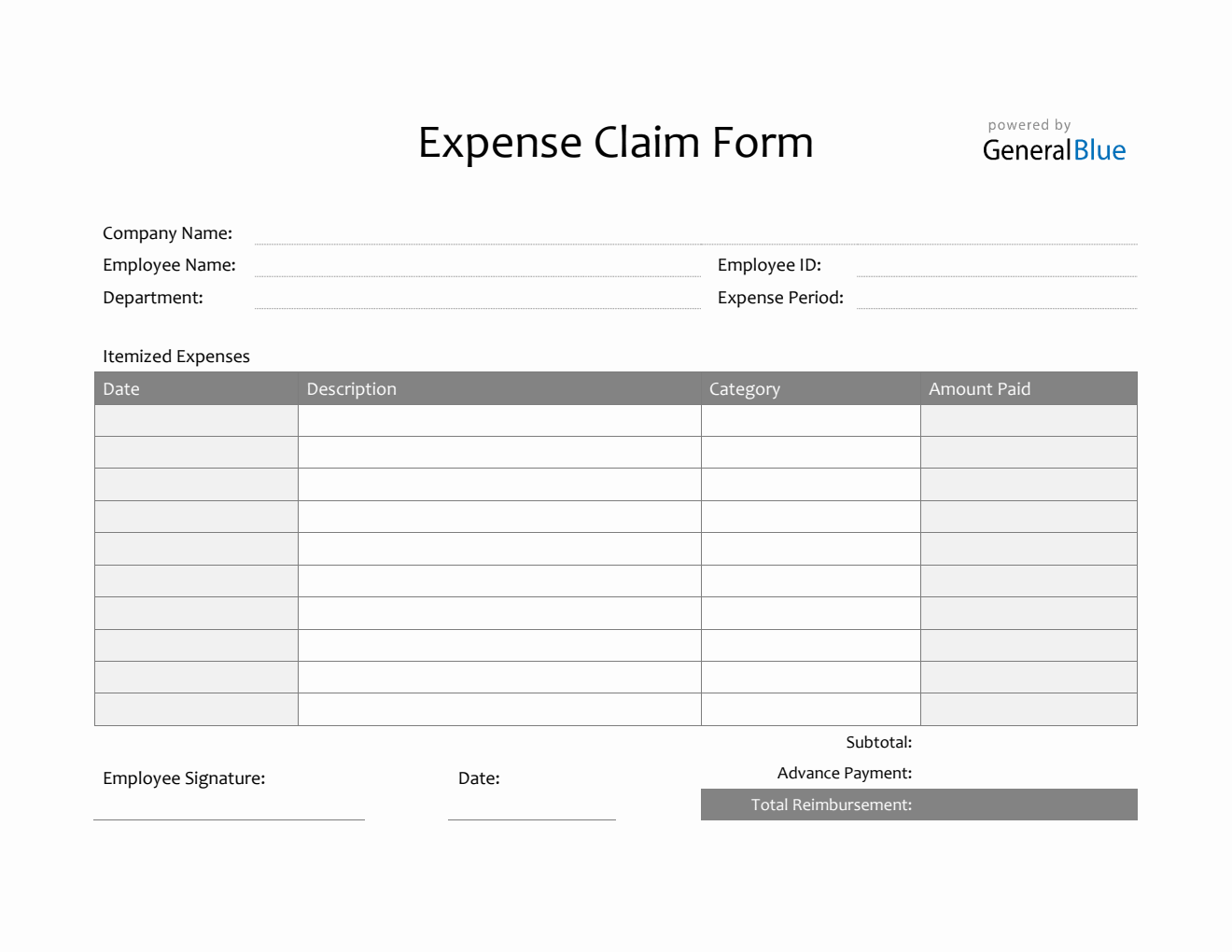

The following two tax credits are applicable to higher education expenses. To claim the aotc or llc, use form 8863, education credits (american opportunity and lifetime learning credits). The aotc can be claimed for qualified expenses that were paid with student loans.

Whether you’re a student or the parent of a student, if you paid for college, you may be eligible for an education tax credit. Additionally, if you claim the aotc, the law requires you to. In general, this includes costs of attending an eligible.

Food clothing lodging dental or medical expenses (out of pocket) education college student loans count as support by. You must pay the expenses for higher education that result in a degree or other recognized education credential. Harvard, with it’s $50.9 billion endowment, has been spending just over $20 million annually on legal expenses since 2019, according to irs filings.

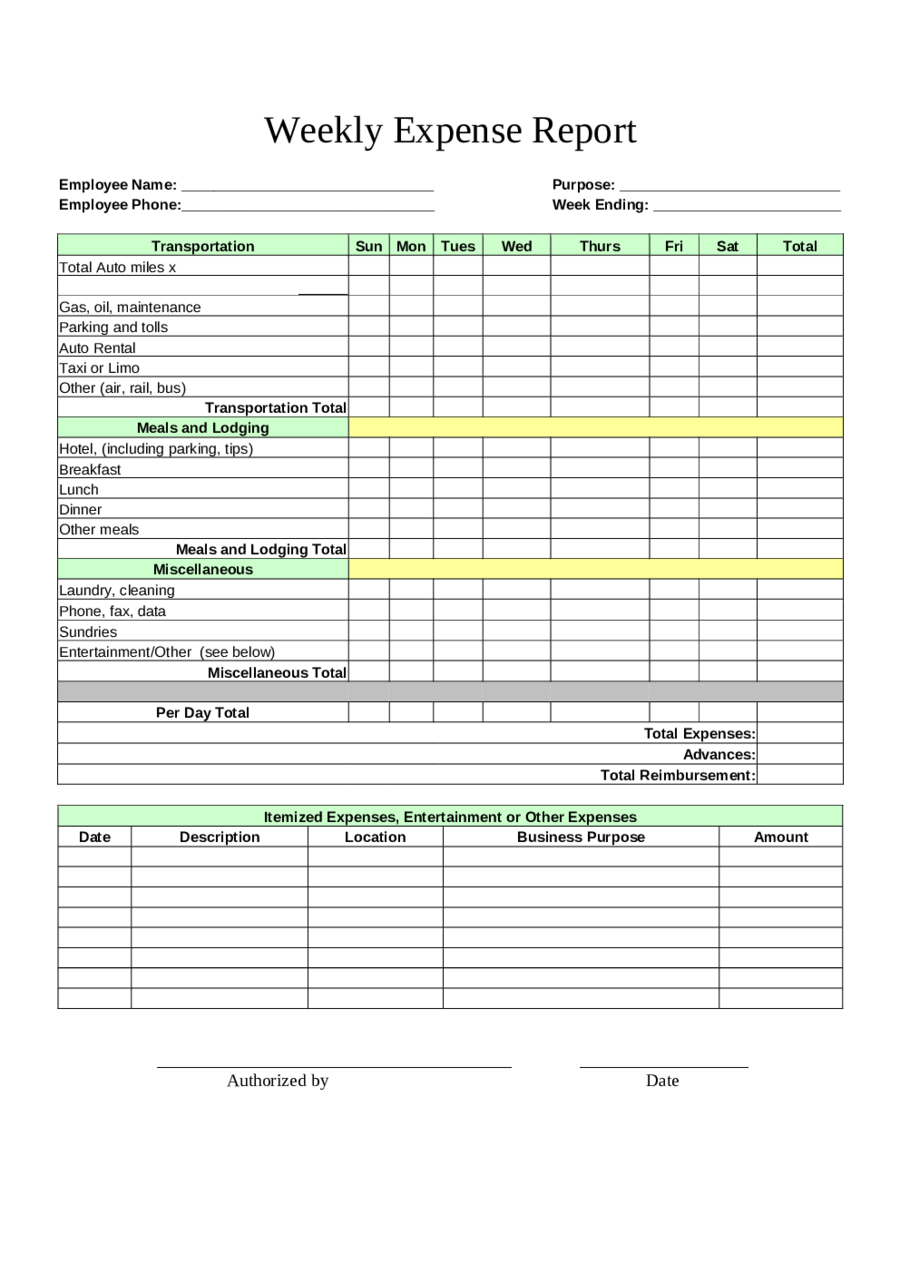

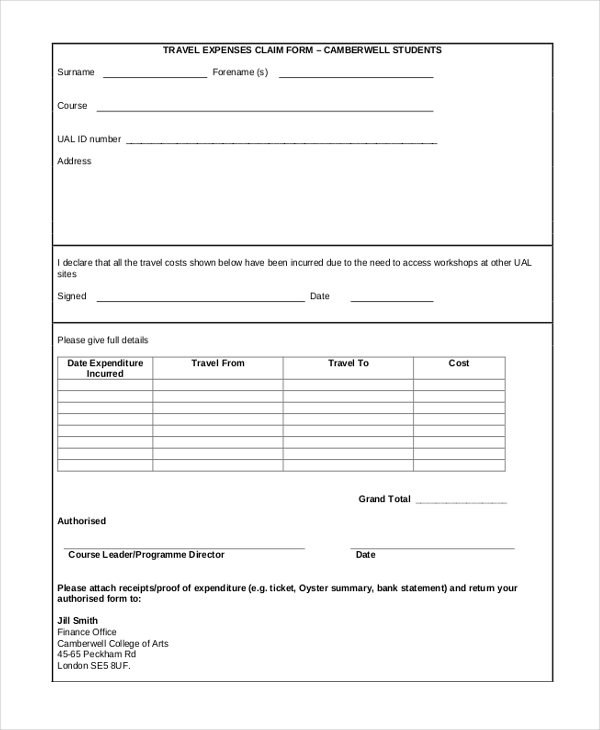

Here are some guidelines: If you’re submitting several expenses in one claim, consider numbering your.

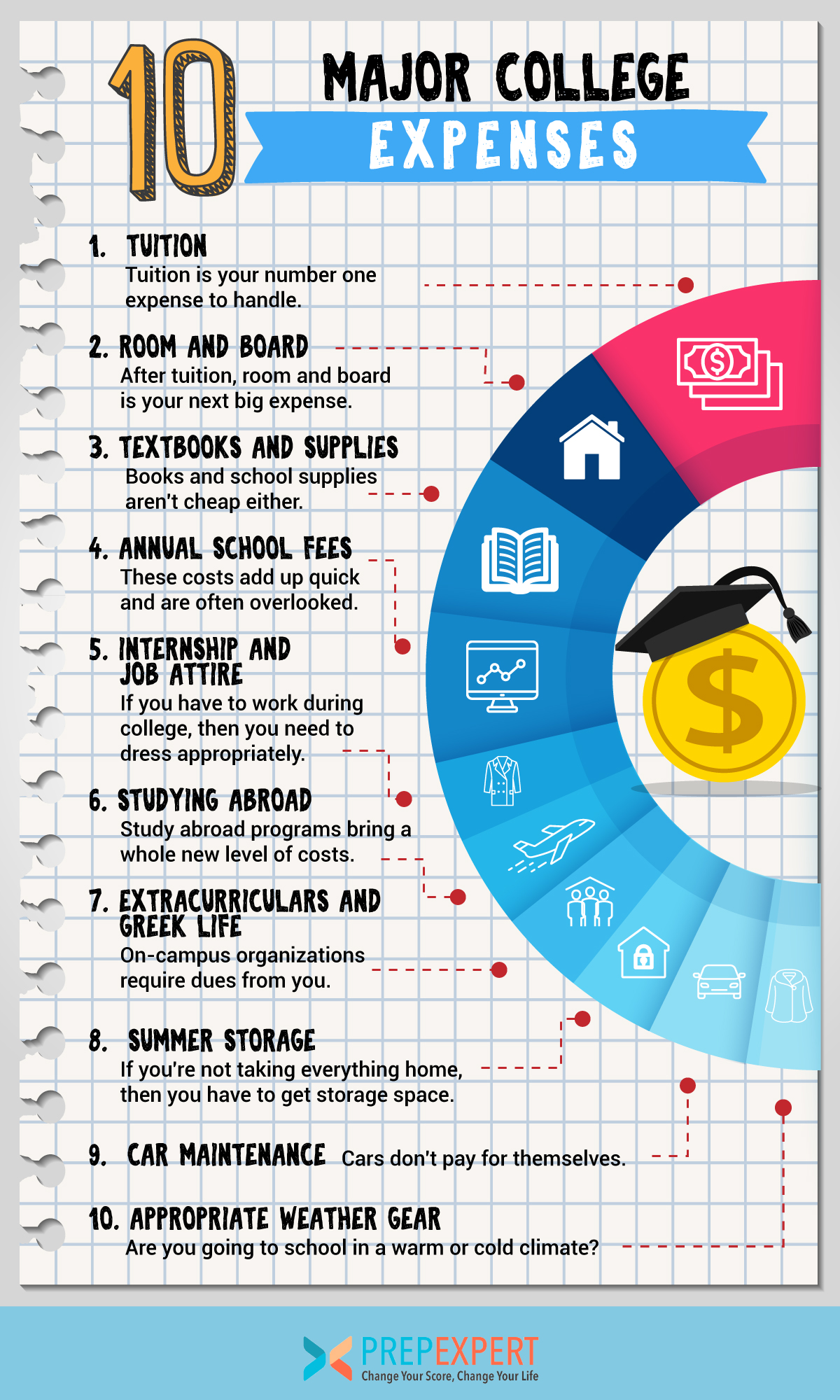

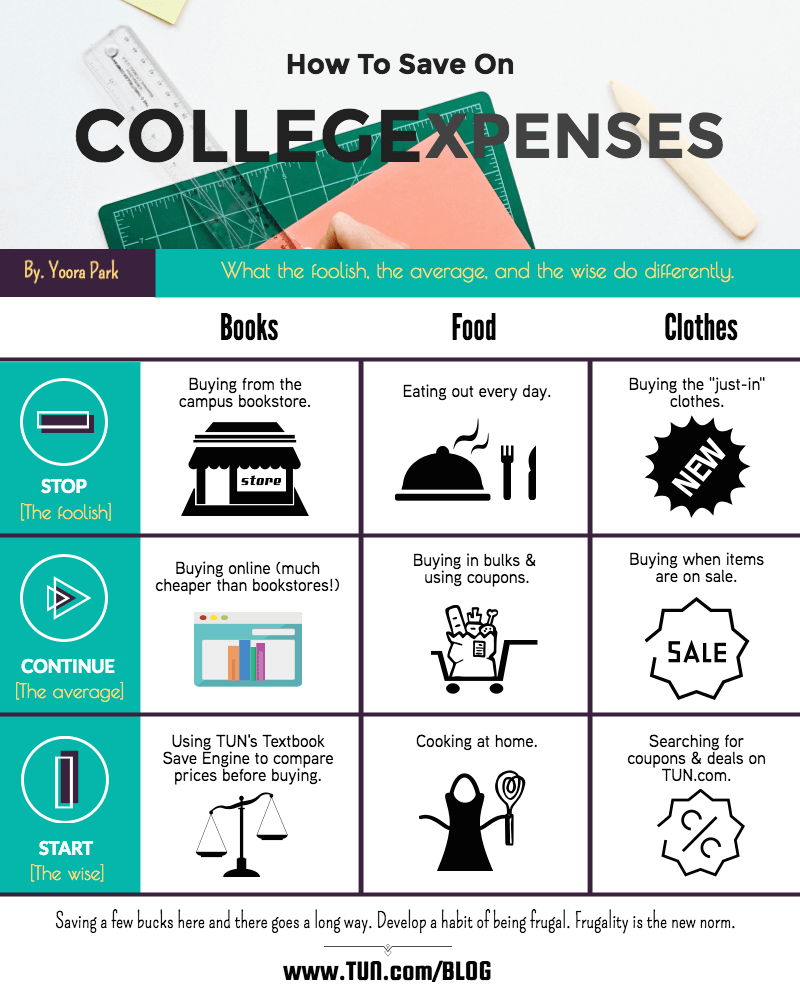

![How to Avoid Unnecessary College Expenses [Infographic] Career Glider](https://www.careerglider.com/wp-content/uploads/2014/11/CareerGlider_CollegeExpenses_Infographic_ak_v2-page-001.jpg)