Underrated Ideas Of Info About How To Handle Accounts Receivable

Small business tips managing your accounts receivable is an integral part of running your own business.

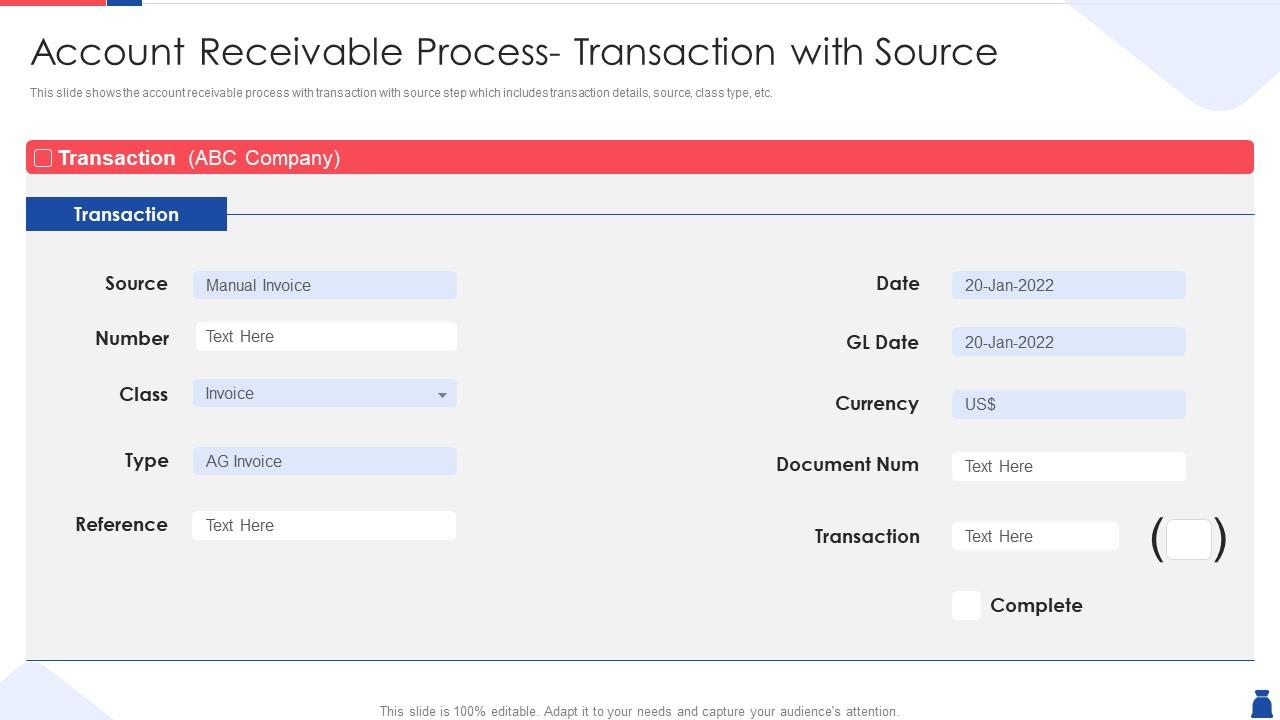

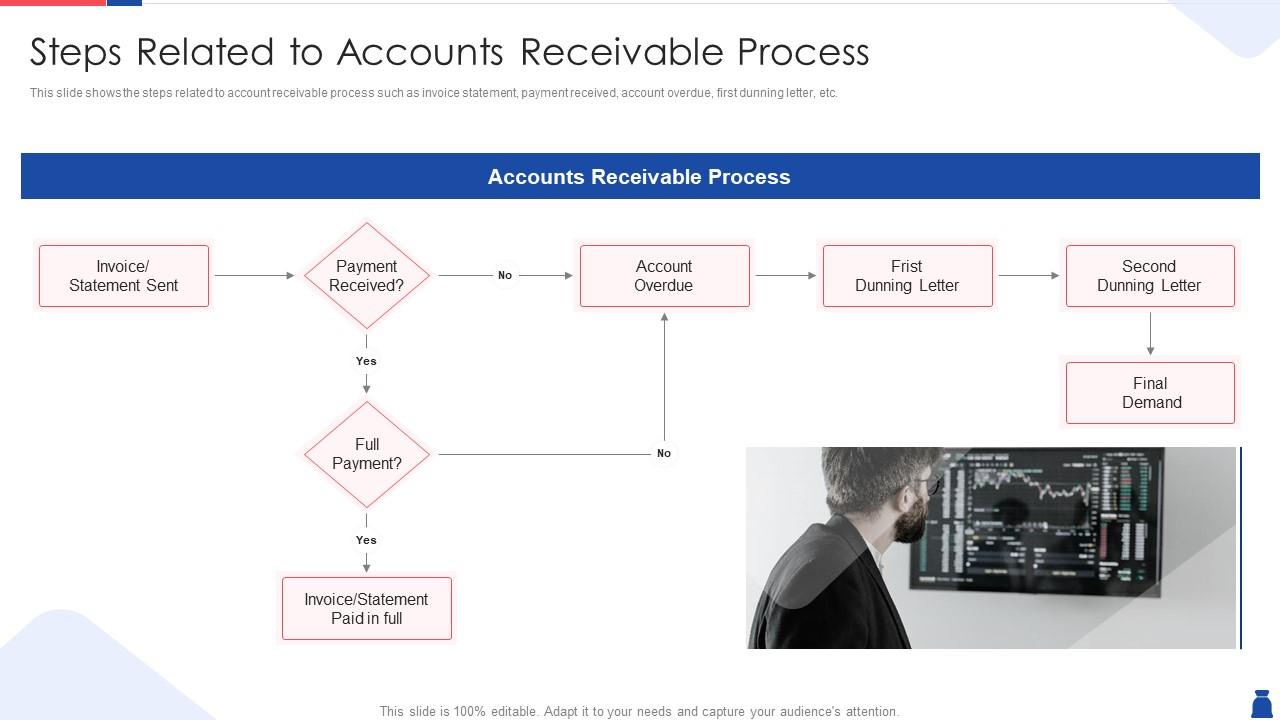

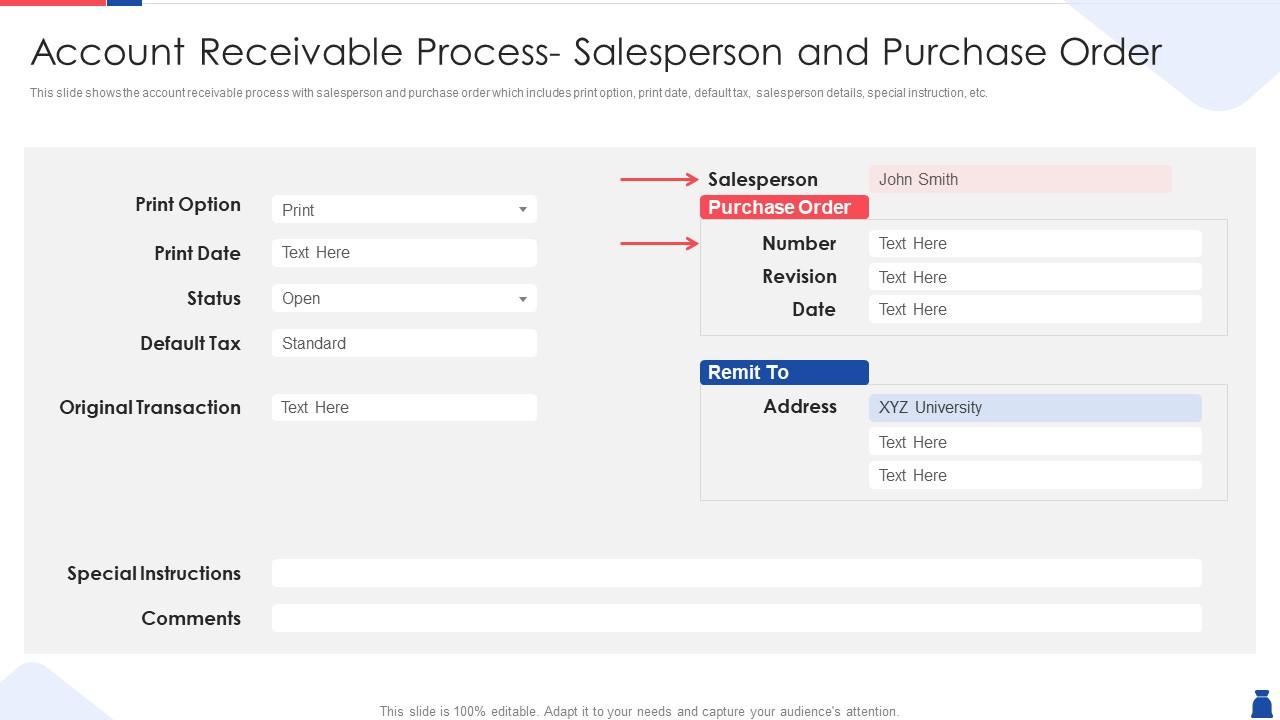

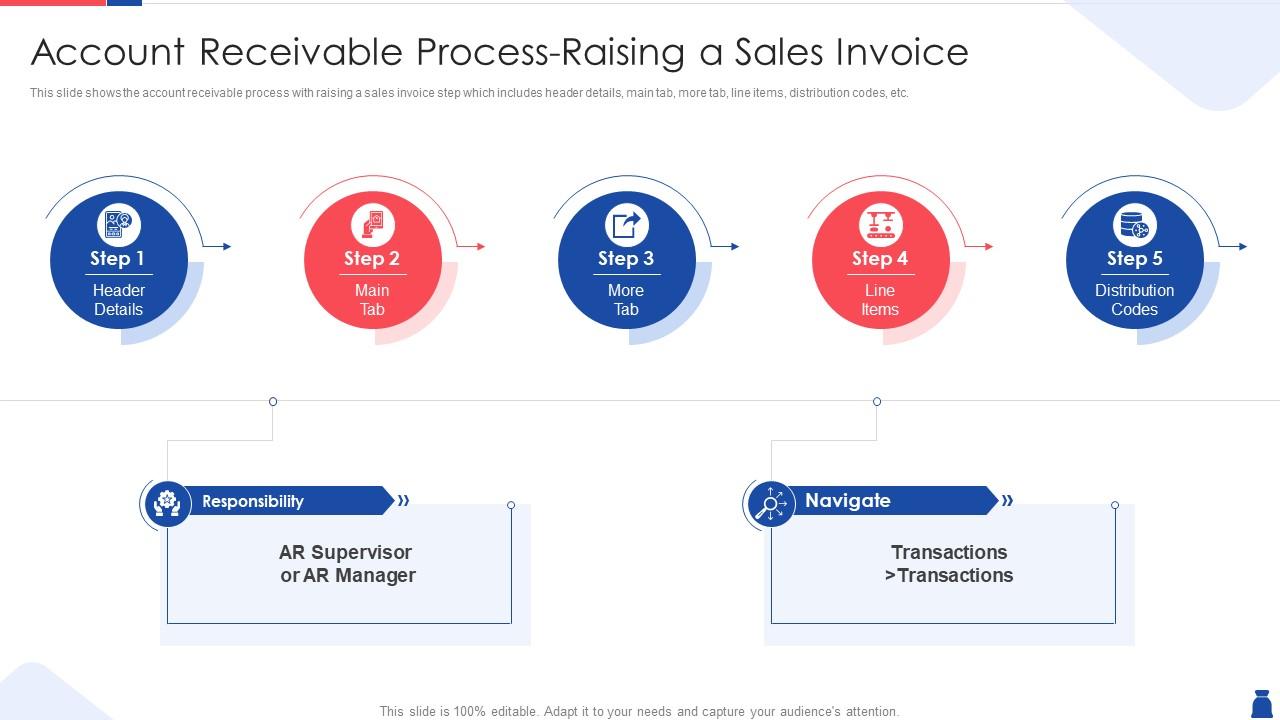

How to handle accounts receivable. Managing accounts receivable begins before the first invoice goes out. This is because your accounts receivable is extremely crucial for any business process. Follow sound accounts receivable practices right from the start during customer acquisition and sales.

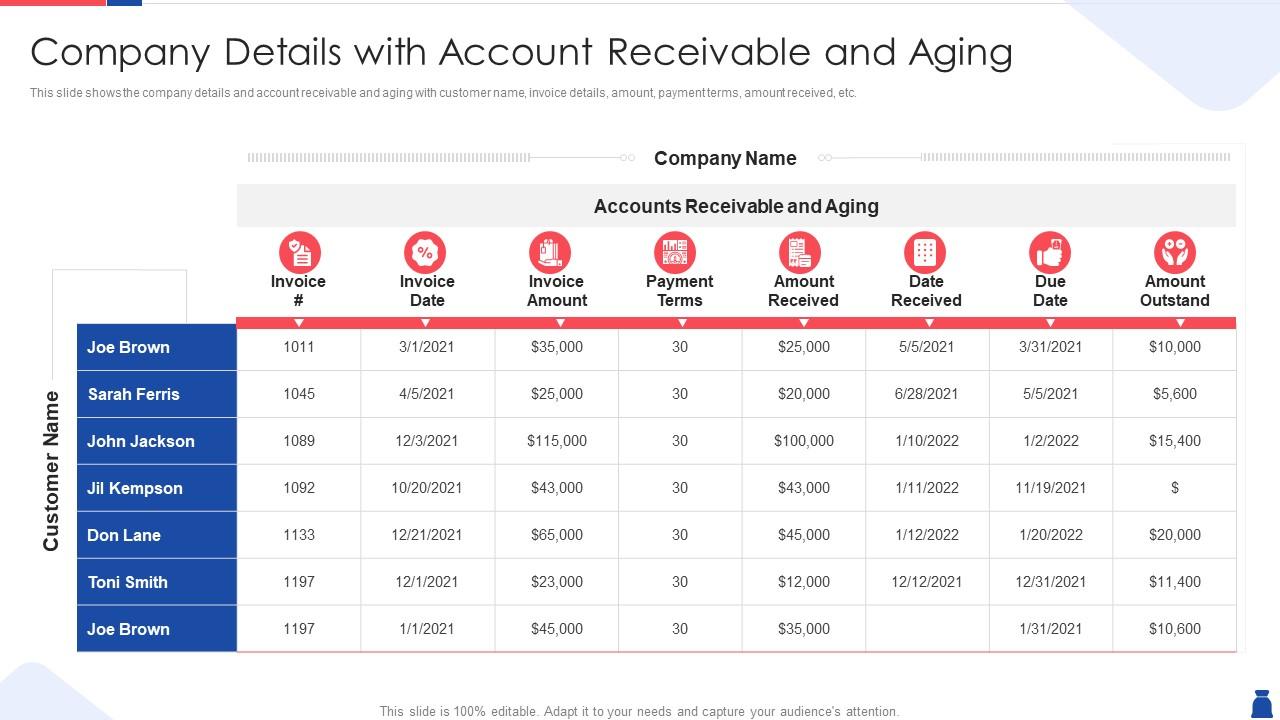

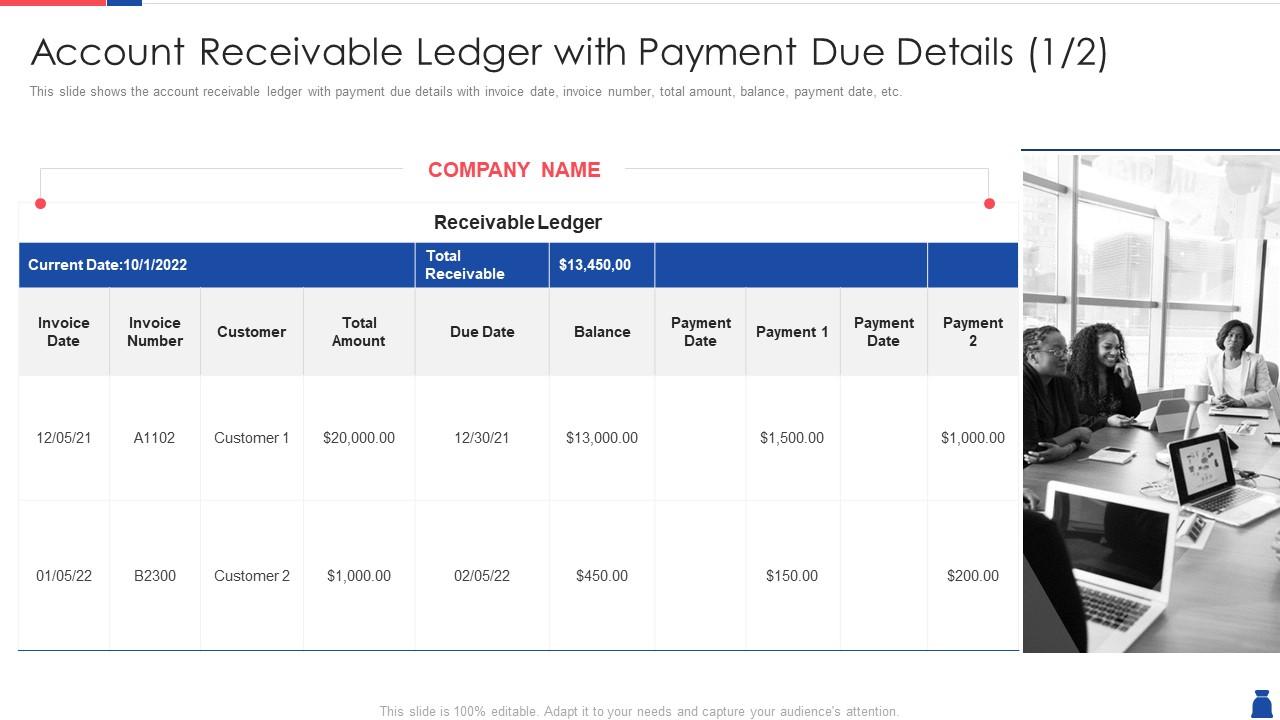

Managing accounts receivable effectively is crucial in keeping cash flowing and your business finances healthy. Be sure you have the ability to produce an. Conceptually, accounts receivable represents a company’s total outstanding (unpaid) customer invoices.

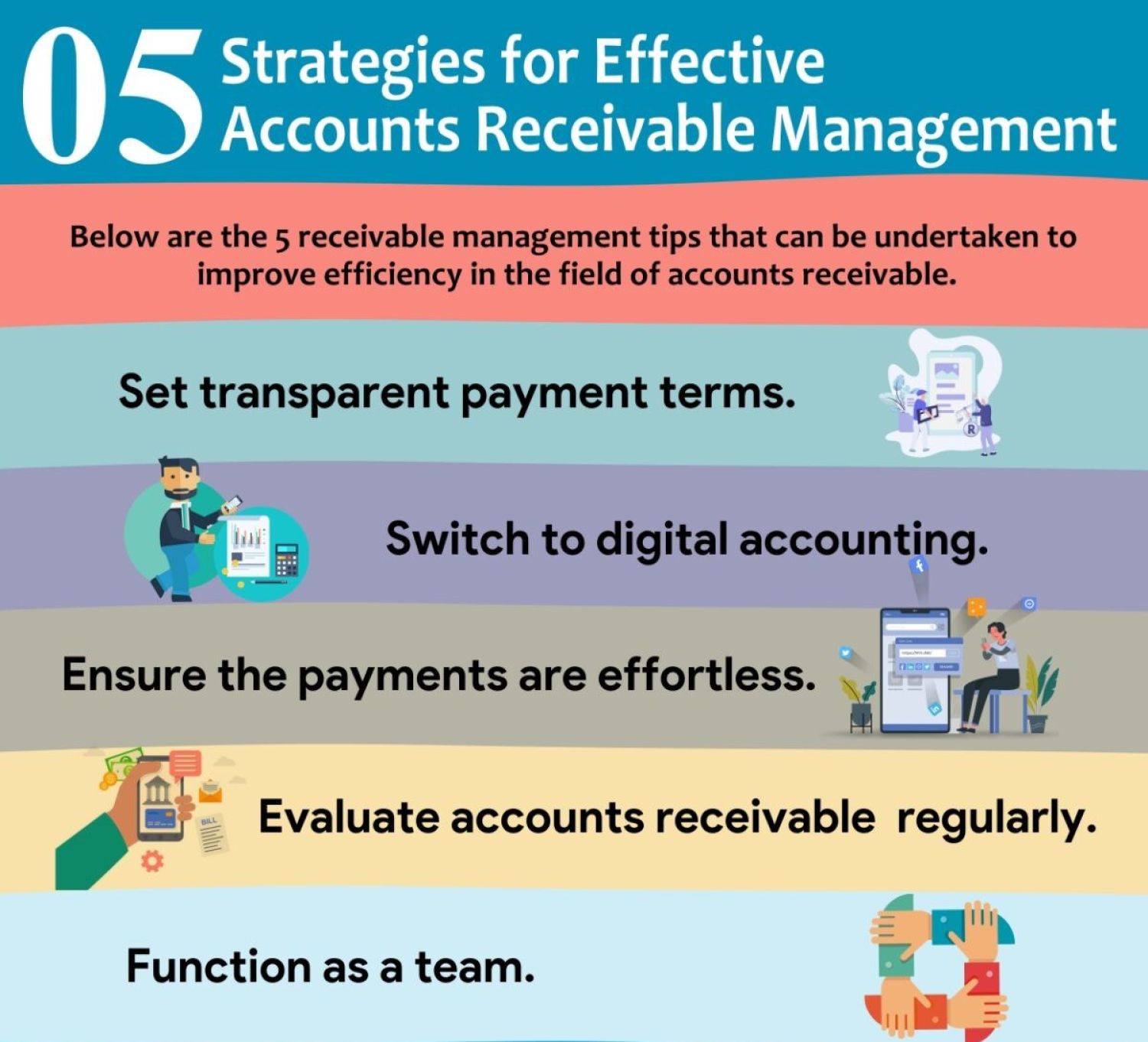

Strong accounts receivable processes can improve every other aspect of your business. Listed as a current asset on the balance sheet, accounts receivable represents the value of all outstanding invoices. How to improve accounts receivable management process?

A procedures manual ensures that routine tasks are completed in. Accounts receivable (ar) is crucial for business success. Accounts receivable management refers to the approach taken to managing and collecting outstanding customer payments, which are collectively labeled accounts receivable.

Offering credit to customers can be a risky move, even for a seasoned business owner. (in this case, in the form of a future cash payment.) Be sure to develop a credit approval process for your.

To increase your chances of collecting your accounts receivable on time, outline your credit terms. But it is also one of the most difficult. Every business should maintain a written procedures manual for the accounting system, and the manual should include specific procedures for managing accounts receivable.

It includes essential functions like invoice management, collecting payments, assessing credit risks, and resolving disputes. This is the top metric you want to optimize your processes. You can find your accounts receivable balance under the ‘current assets’ section on your balance sheet or general ledger.

By managing your ar process effectively, you can improve your cash flow, increase revenue, and build better customer relationships. Those are easy to lose. Here are some tips you can implement to optimize your accounts receivable process:

Get the money owed to you by managing accounts receivables. Create an invoice for your customers. Learn how to improve the process with these best practices.

Sign a contract and check credit. Account receivables is a critical part of an accrual accounting system, allowing business owners to manage cash flow and keep an accurate, organized balance. Here are 10 tips on how to manage accounts receivable operations:

.jpg)