Outstanding Info About How To Apply For Homestead Exemption In Broward County Florida

Under the homestead exemption, florida law allows.

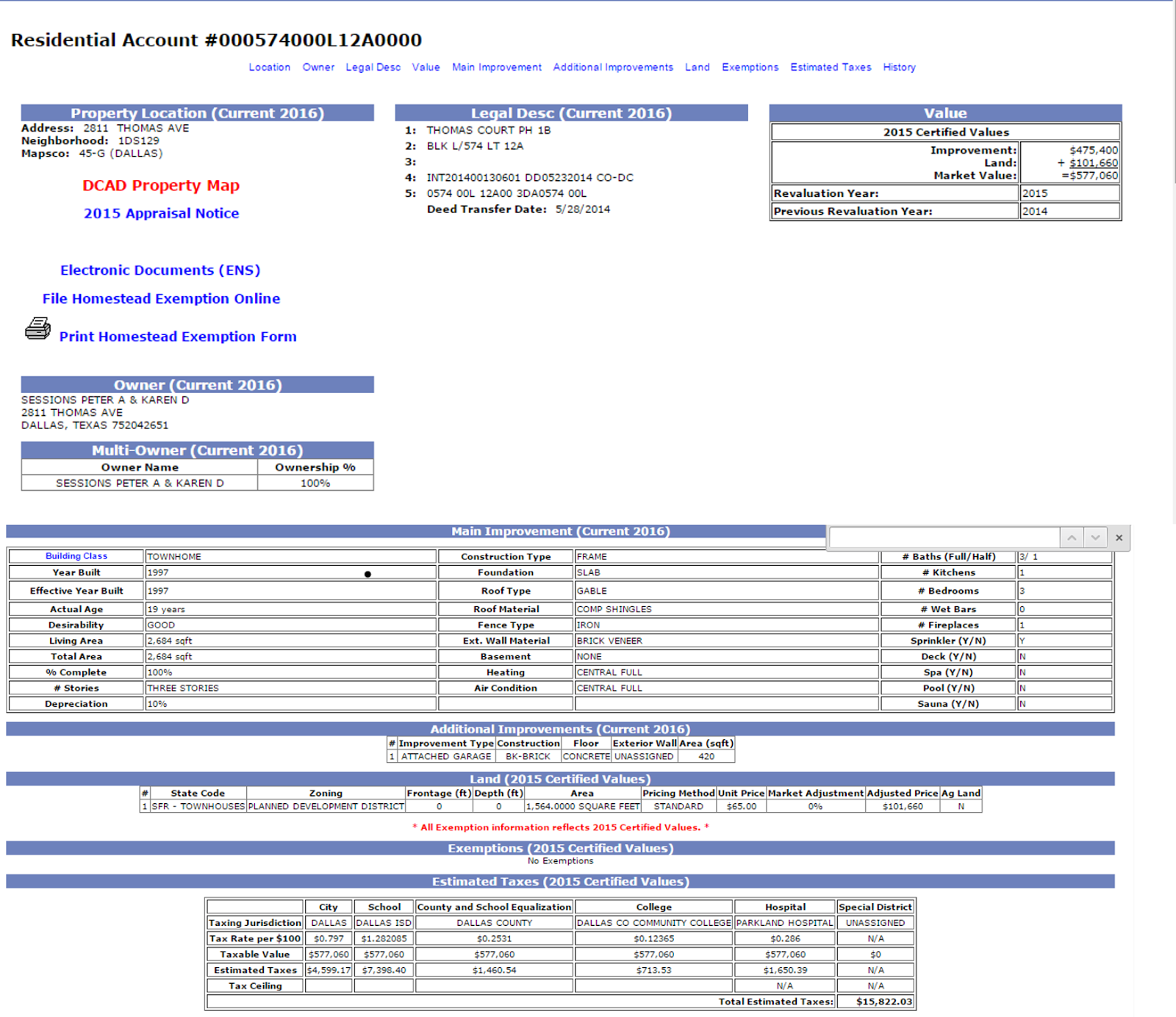

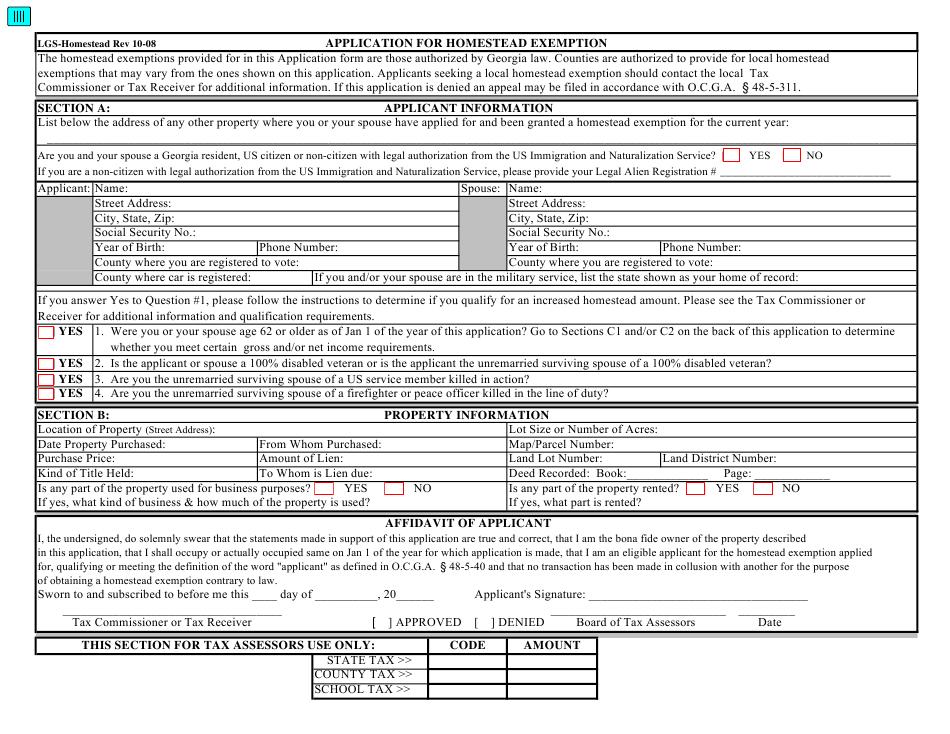

How to apply for homestead exemption in broward county florida. The homestead property tax deferral act provides for a program in which eligible individuals entitled to claim homestead tax exemption under the provisions of f.s. New homeowners in florida should get acquainted with what the laws are, and how they are administered. Under the homestead exemption, florida law allows up to $50,000 to be deducted from the assessed value of a primary / permanent residence.

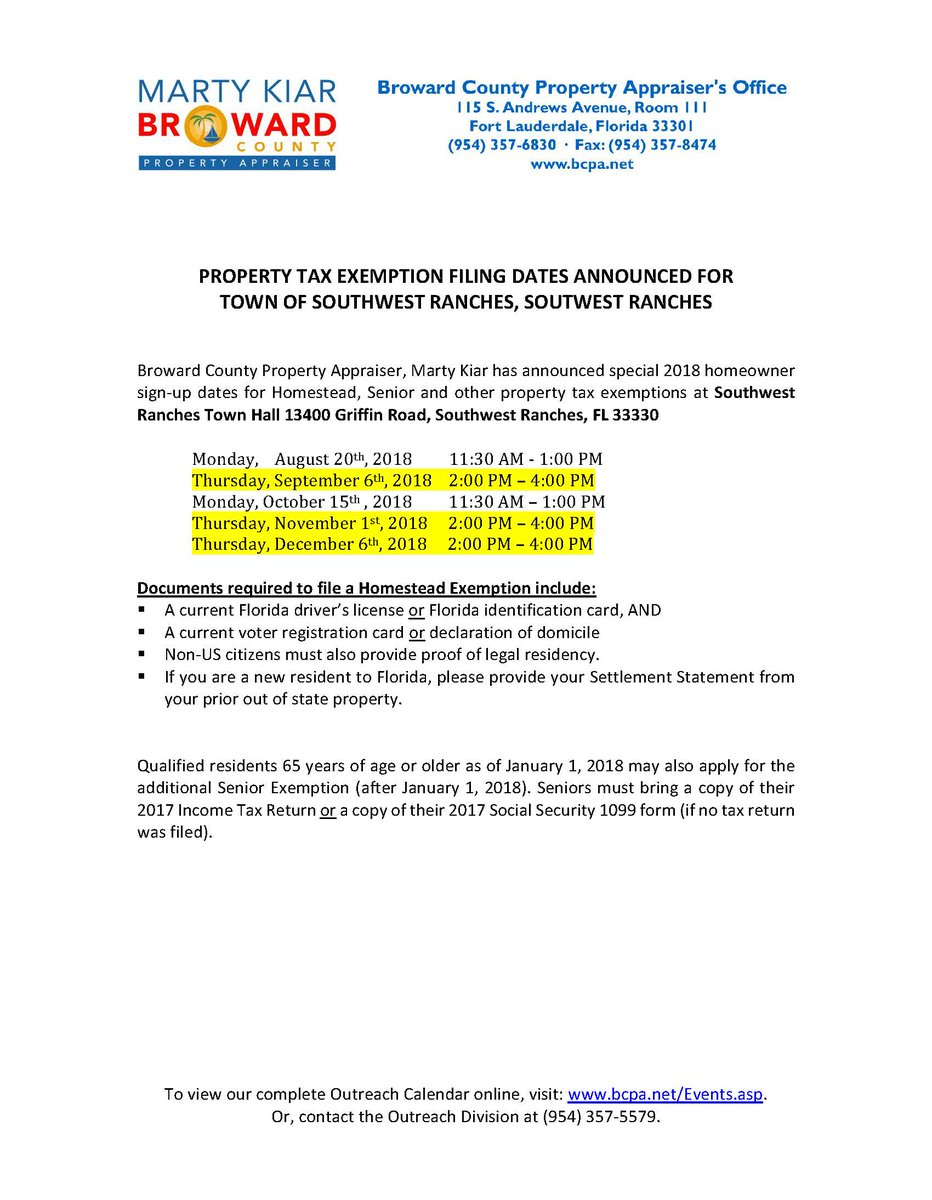

You may file for 2022 homestead online by clicking the large yellow button in the navigation menu on the top left side of this page. Or you may file by. Property owners in florida may be eligible for the homestead exemption (which includes the 3% cap) as well as additional exemptions that can help in reducing your assessed.

Current florida driver’s license or florida id card. Documents required to file a homestead exemption include: Or you may file by visiting our office.

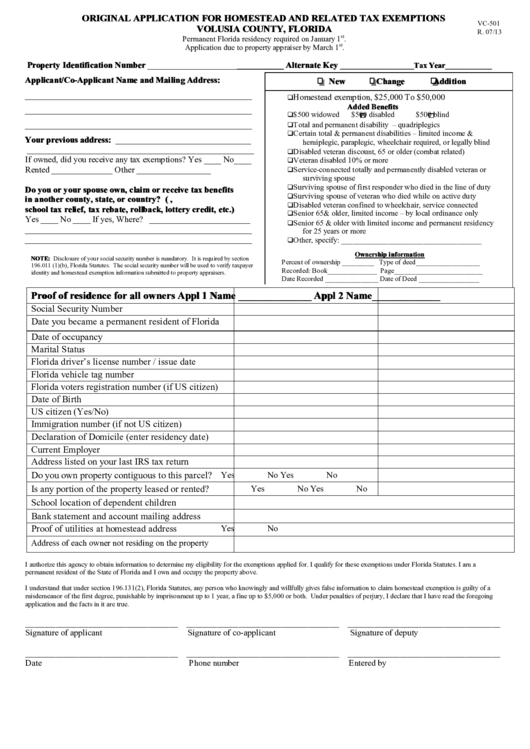

You cannot transfer your homestead exemption when you move from a previous florida homestead to a new florida homestead. You can file your homestead exemption online at www.bcpa.net or at the broward county property appraiser office (bcpa) located at 115 south andrews avenue,. Applications & related forms:

For information on homestead exemption in broward county, see the broward county. How do you qualify for a homestead exemption in florida? Documents required to file an exemption include:

While the tax savings from an exemption could be significant, not everyone is eligible. Board of county commissioners or the governing authority of any municipality may adopt an ordinance to allow an additional homestead exemption of up to $50,000. You may file for 2022 homestead online by clicking the large yellow button in the navigation menu on the top left side of this page.

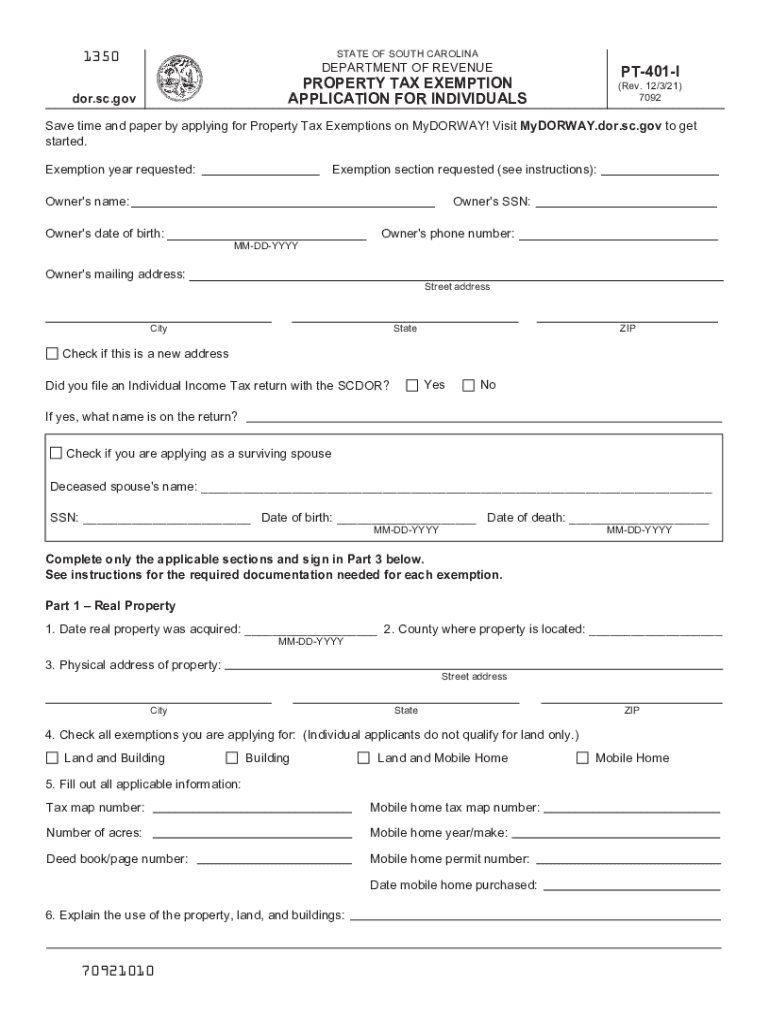

Andrews avenue, room 111 fort lauderdale, florida 33301 954.357.6830 fax: Submit all applications and documentation to the property appraiser in the county where the property is located. For local information, contact your county property appraiser.

A current florida driver’s license or florida identification card. However, you may be able to transfer all or. Click here to file for homestead exemption online note:

You must apply for homestead exemption on the new property and submit a portability application. Broward county property appraiser’s office 115 s. Valid voter id or address declaration.